Simple bookkeeping for small business is the secret sauce to keeping financial chaos at bay, understanding your business’s health, and ensuring growth. Many small business owners find themselves tangled in financial complexities. Here’s a quick answer to what you really need for simple bookkeeping:

- Keep Personal and Business Finances Separate: Avoid mixing personal and business expenses.

- Track Everything: Record every transaction—no matter how small.

- Use Financial Statements: Regularly review income statements, balance sheets, and cash flow statements.

- Plan for Taxes in Advance: Always keep tax liabilities in mind to avoid surprises.

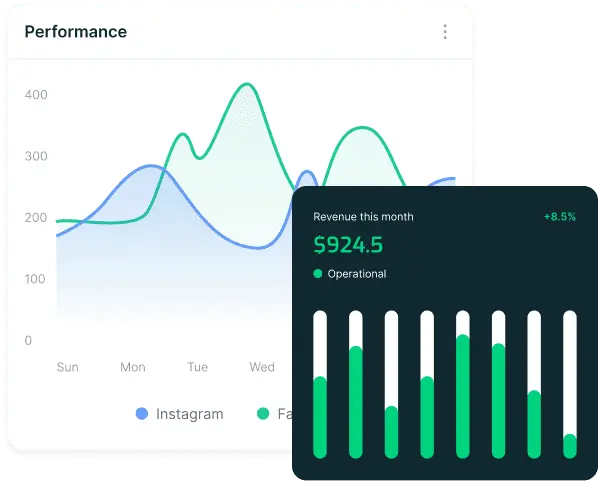

- Leverage Technology: Use bookkeeping software to streamline processes and reduce errors.

Maintaining organized and clear financial records not only simplifies tax season but underpins your ability to make strategic decisions throughout the year. This leads to improved financial health, paving the way for better management and growth opportunities.

I’m Russell Rosario, co-founder of Profit Leap. My expertise as a fractional CFO and CPA has equipped me with the insights to empower small businesses through simple bookkeeping practices. Let’s explore how getting organized and maintaining financial clarity can transform your business.

Understanding Bookkeeping Basics

Bookkeeping might seem like a daunting task, but it’s really about understanding a few key elements that keep your business running smoothly.

Recording Transactions

At the heart of simple bookkeeping for small business is recording transactions. This means every sale, purchase, payment, and receipt needs to be documented. Think of it as your business’s diary—capturing every financial move you make.

Tip: Use bookkeeping software to automate this process. It saves time and reduces human error.

Financial Statements

Financial statements are your business’s report cards. They help you understand how well you’re doing financially.

-

Income Statement: Also known as the Profit and Loss Statement, this shows your revenue and expenses over a period. It’s like a snapshot of your business’s profitability.

-

Balance Sheet: This details your assets, liabilities, and equity. It gives you a clear picture of what you own and owe.

-

Cash Flow Statement: This tracks how cash moves in and out of your business. It’s crucial for understanding liquidity.

Accounts Payable and Accounts Receivable

Accounts Payable and Accounts Receivable are two sides of the same coin.

-

Accounts Payable: This is money you owe to suppliers. Keeping track of these ensures you pay your bills on time and maintain good relationships with vendors.

-

Accounts Receivable: This is money owed to you by customers. Monitoring this helps you chase down late payments and keep your cash flow healthy.

Pro Tip: Regularly review and update these accounts to prevent cash flow problems.

By mastering these basics, you can ensure that your business’s financial foundation is strong. This understanding not only aids in day-to-day operations but also empowers you to make informed decisions for future growth.

Simple Bookkeeping for Small Business

When it comes to managing your small business finances, simplicity is key. Let’s break down the essentials of simple bookkeeping for small business into four main approaches: single-entry bookkeeping, double-entry bookkeeping, cash-based accounting, and accrual-based accounting.

Single-Entry Bookkeeping

Single-entry bookkeeping is like keeping a checkbook register. It’s straightforward and easy to manage. Each transaction is recorded once, either as an income or an expense. This method works well for sole proprietors and very small businesses with minimal transactions.

- Pros: Simple and requires minimal training.

- Cons: Doesn’t provide a comprehensive view of financial health.

Example: If you own a small bakery, you might record sales from the cash register and expenses for flour and sugar in a single ledger.

Double-Entry Bookkeeping

Double-entry bookkeeping is more detailed and accurate. Every transaction affects at least two accounts—one as a debit and the other as a credit. This method ensures your books are always balanced.

- Pros: Reduces errors and provides a complete financial picture.

- Cons: More complex and time-consuming.

Tip: Use software to automate entries and reduce human error. This is especially useful if your business deals with inventory or has multiple revenue streams.

Cash-Based Accounting

Cash-based accounting records transactions when cash actually changes hands. It’s simple and gives you a clear view of your cash flow.

- Pros: Easy to understand and manage.

- Cons: May not reflect the true financial position of your business.

Scenario: A freelance graphic designer might use cash-based accounting, recording income when clients pay and expenses when bills are paid.

Accrual-Based Accounting

Accrual-based accounting records income and expenses when they are incurred, not when cash is exchanged. This method aligns with generally accepted accounting principles and provides a more accurate financial picture.

- Pros: Offers a comprehensive view of your business’s financial health.

- Cons: More complex and can be time-consuming to maintain.

Best For: Businesses looking to scale or those with complex transactions, such as a retail store with inventory purchases and sales on credit.

Understanding these bookkeeping methods helps you choose the right approach for your business. Whether you opt for the simplicity of single-entry or the accuracy of double-entry, the key is to stay consistent and organized.

Next, we’ll explore Essential Bookkeeping Tools and Software to help streamline your bookkeeping process.

Essential Bookkeeping Tools and Software

Managing your small business finances can be a breeze with the right tools and software. Let’s explore the essentials that can simplify your bookkeeping tasks.

Accounting Software

Accounting software is a game-changer for small businesses. It automates many bookkeeping tasks, reducing the time and effort you need to invest. With options like Profit Leap’s own solutions, you can track expenses, manage invoices, and generate financial reports with ease.

Key Features to Look For:

- Income and Expense Tracking: Automatically categorize transactions to keep tabs on where your money is going.

- Financial Reporting: Generate real-time reports to understand your business’s financial health.

Tip: Choose software that integrates with your bank accounts for seamless data transfer and reconciliation.

Automation

Automation is your best friend in bookkeeping. It minimizes manual data entry and reduces the chance of errors. Many accounting software solutions offer automation features that handle repetitive tasks like invoicing and transaction categorization.

Benefits of Automation:

- Efficiency: Saves time by handling routine tasks.

- Accuracy: Reduces human errors in data entry.

Example: Set up automated invoicing to send bills to clients on a regular schedule, ensuring you never miss a payment.

Expense Tracking

Keeping track of expenses is crucial for maintaining a healthy cash flow. Accounting software often includes tools to capture receipts and categorize expenses, making it easier to manage and review your spending.

Features to Consider:

- Receipt Capture: Use your smartphone to snap photos of receipts and upload them directly to your accounting system.

- Budgeting Tools: Set spending limits and monitor expenses to stay within budget.

Scenario: A small café owner can use expense tracking to monitor costs for ingredients and supplies, ensuring they stay profitable.

Invoicing

Invoicing is a vital part of any business, and accounting software can simplify this process. Automated invoicing ensures clients are billed promptly and payments are tracked efficiently.

Invoicing Tools:

- Customizable Templates: Create professional invoices that reflect your brand.

- Recurring Invoices: Set up automatic billing for regular clients to save time.

Pro Tip: Use software that sends automatic payment reminders to reduce late payments and improve cash flow.

By leveraging these essential tools and software, you can streamline your bookkeeping processes and focus more on growing your business. Whether it’s automating routine tasks or tracking expenses with ease, these solutions make simple bookkeeping for small business achievable for any entrepreneur.

Next, we’ll discuss How to Manage Bookkeeping Efficiently to ensure your financial records are always up-to-date and accurate.

How to Manage Bookkeeping Efficiently

Efficient bookkeeping is the backbone of any successful small business. Keeping your financial records up-to-date ensures you can make informed decisions and stay on top of your financial health. Here’s how to manage your bookkeeping like a pro.

Daily Records

Keeping daily records is crucial. It might sound tedious, but it’s your best defense against errors and oversights. By recording transactions every day, you ensure that your financial data is always accurate and current.

Why it matters:

- Accuracy: Daily updates prevent errors from piling up.

- Clarity: You always know your financial status.

Tip: Set aside a specific time each day to enter transactions, even if it’s just 10 minutes. Consistency is key.

Audit Trail

An audit trail is a detailed record of all your financial transactions. It’s like a breadcrumb trail that shows where your money comes from and where it goes. This is vital for tracking down errors and ensuring compliance with regulations.

Benefits of an audit trail:

- Transparency: Provides clear documentation of all transactions.

- Accountability: Makes it easier to spot and correct mistakes.

Example: If a discrepancy arises, an audit trail allows you to trace the transaction history and resolve issues quickly.

Expense Tracking

Expense tracking is all about knowing where your money is going. By categorizing expenses, you can identify areas to cut costs and improve your bottom line.

How to track expenses effectively:

- Categorize Expenditures: Group similar expenses together for easy analysis.

- Use Technology: Leverage software to automate and simplify tracking.

Scenario: A freelance graphic designer uses expense tracking to monitor software subscription costs and client meeting expenses, ensuring they stay profitable.

Tax Preparation

Tax preparation doesn’t have to be a last-minute scramble. By keeping organized records throughout the year, you can make tax season a breeze.

Steps for stress-free tax prep:

- Organize Receipts: Keep digital copies of all receipts for easy access.

- Stay Informed: Keep up with tax regulations to ensure compliance.

Pro Tip: Use accounting software that integrates with tax preparation tools to streamline the filing process.

By implementing these strategies, you can manage your bookkeeping efficiently and keep your small business on the path to success. Next, we’ll tackle some Frequently Asked Questions about Simple Bookkeeping for Small Business, providing answers to common concerns entrepreneurs face.

Frequently Asked Questions about Simple Bookkeeping for Small Business

Can I do my own bookkeeping?

Absolutely! Many small business owners choose to handle their own bookkeeping, especially in the early stages. With the right tools and a bit of dedication, you can manage your finances effectively.

Self-taught bookkeeping is a viable option, thanks to the plethora of resources available online. You can find tutorials, courses, and guides to help you understand the basics.

Using accounting software can simplify the process even further. These programs automate many tasks, like recording transactions and generating reports, making it easier for non-experts to keep their books in order.

What is the simplest form of bookkeeping?

The simplest form of bookkeeping is single-entry bookkeeping. It’s similar to keeping a personal checkbook. You record each transaction once, making it straightforward and easy to maintain.

Single-entry bookkeeping is ideal for very small businesses with a low volume of transactions. It’s perfect if your focus is on tracking income and expenses without the complexity of a double-entry system.

Additionally, cash-based accounting is often considered simple because you record transactions when cash changes hands. This means you only track actual payments and receipts, which simplifies the bookkeeping process.

Do small businesses need bookkeeping?

Yes, small businesses absolutely need bookkeeping. It’s crucial for maintaining financial health and ensuring tax compliance.

Without proper bookkeeping, you risk losing track of your financial situation. This can lead to cash flow problems and missed opportunities for growth. Plus, accurate records are essential for filing taxes correctly and avoiding penalties.

Bookkeeping helps you understand your business’s profitability, manage expenses, and make informed decisions. In short, it’s not just about compliance—it’s about setting your business up for long-term success.

By addressing these common questions, we hope to make simple bookkeeping for small business more accessible and less intimidating. Let’s move on to exploring the essential tools and software that can further ease your bookkeeping journey.

Conclusion

As we wrap up our exploration of simple bookkeeping for small business, it’s clear that effective bookkeeping is essential for maintaining financial health and ensuring your business thrives. But where do you go from here? This is where Profit Leap steps in.

At Profit Leap, we understand that managing your business finances can be challenging. That’s why we’ve combined our CEO and CFO expertise with advanced AI technology to create Huxley, the first AI business advisor. Huxley is designed to provide small business owners with custom insights and customized business metrics.

Huxley acts as your business’s co-pilot, offering precise forecasting and actionable insights that not only help you react to changes but also empower you to lead them. Imagine having a partner that evolves with your business, providing you with the guidance needed to make informed decisions and drive growth.

By leveraging our cutting-edge business intelligence tools, you can simplify your bookkeeping tasks and focus on what you do best—running your business. Our blend of artificial and human intelligence ensures that you’re equipped to meet today’s challenges and innovate for tomorrow.

Ready to take the next step in optimizing your bookkeeping processes? Explore our services and let Profit Leap guide you toward unparalleled success.

With Profit Leap and Huxley by your side, you’re not just managing your finances—you’re setting your business up for a brighter future.